In recent days, HMRC is ramping up its investigation into unreported landlords and has made up to 58,000 disclosures.

Since 2013, the government has launched a “rental property campaign” and has recovered almost £250 million in unpaid tax.

If you are renting out a property or renting out part of it, you may need to pay more attention to tax issues.

Rental Income

The first thing you need to know when understanding rental income reporting is what expenses are counted as rental income:

- Use of furniture

- Hygiene and cleanliness of public areas

- Hot water

- Heating

- Property maintenance

Rental Income Tax

Rental also needs to be counted as income, so again, you need to pay income tax on this net income each month.

Rental income is also the profit you make, and when you rent out more than one property, you need to add the profit and loss together.

Note here that losses from overseas property CANNOT be mixed with UK rental profits.

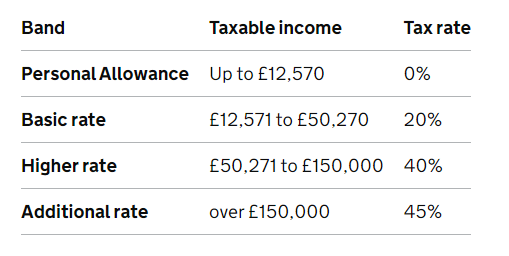

Rental Income Tax Rate

The income tax rate and threshold for your rental income are the same as personal income tax.

However, once your net rental income is added to other income, you may enter a higher tax bracket.

If your annual salary is £20.000, the net rental income is £10.000 per annum.

After adding up, you will need to pay 20% personal income tax on the total income of 30.000 pounds.

How to Declare

Landlords are required to file a self-assessment tax return to pay rental income tax.

A self-assessment tax return is usually required for each tax year (April 6 – April 5 of the following year).

HMRC uses the information in the table to determine the tax payable, which includes evidence of every expense you spend on maintaining the property.

Penalty

HMRC will look for undeclared landlords through a wide range of investigative resources, including door-to-door enquiries and public disclosures.

Landlords who are identified as tax evaders face serious penalties for voluntarily disclosing their income.

10% or 100% of rental income will be deducted depending on the circumstances. HMRC goes back 20 years and conducts criminal investigations.

In any case, failing to declare rental income is a criminal offense. Ask our professional accounting team now to declare your rental income as soon as possible.