Marriage Allowance is the transfer of a personal allowance of £1,260 from one partner to the husband/wife or civil partner to achieve a certain tax credit.

In most cases, your tax can be reduced by up to £252 during the tax year (6th April to 5th April).

Now log on to the GOV.UK official website and search for “Marriage Allowance” to apply by yourself .

who can apply

- You must be married or in a civil partnership (excluding common-law relationships where you just live together).

- One of you must be a non-taxpayer (a non-taxpayer is a personal allowance for income below £12,570 between 6 April and 5 April the following year).

- If you meet the second condition, the other person must be a 20% taxpayer (with an annual income of less than £50,270.

- If you live in Scotland, you’ll need less than £43,662. Taxpayers with higher or additional tax rates are not eligible for this allowance.

- Both partners must have been born on or after April 6, 1935. If not, there are additional tax benefits.

In short, one of you must be a non-taxpayer and the other must be a basic rate taxpayer.

How to calculate

A partner not using the personal allowance can transfer the £1,260 allowance to the other (so basically 10% of the full allowance).

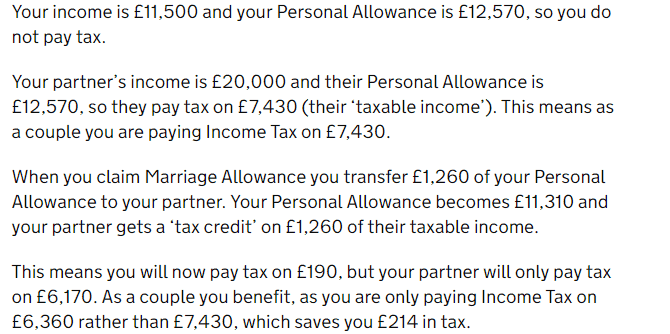

Based on the example in the image above, we can find that when a person does not earn enough to pay tax (£12,570 per annum), they can pass on the £1,260 allowance to their partner.

This saves a portion of the tax on the previous basis even if both spouses are required to pay income tax.

Also, if you meet the criteria for paying the basic tax rate, your significant other does not have any annual income or the £1260 allowance is not passed on to £12,570. You would normally get £252 a year in tax.

Get back the money

If you are eligible and successfully apply, you will also automatically receive a tax deduction each year thereafter – so there is no need to reapply.

The marriage allowance for tax year 2022/23 is up to £252.

In addition to the tax exemption for the current year, you can retroactively track your claim for up to four tax years (currently 2018/19, 2019/20, 2020/21 and 2021/22). Amounts up to:

- 2021/22 – £252

21/2020 – £250

2019/20 – £250

2018/19 – £238

If you apply for the current tax year and go back up to four years, you will receive up to £1,242.